August 14, 2024

Blink Holdings, Inc., DIP (dba Blink Fitness) filed a voluntary Chapter 11 petition in the U.S. Bankruptcy Court for the District of Delaware. Parent Equinox Group is not a debtor in the Chapter 11 cases, and it is not anticipated that it, or any of its affiliates other than the Debtors, will be filing bankruptcy petitions.

The Debtors intend to utilize the Chapter 11 process to enhance liquidity through DIP financing to allow for a value-maximizing sale process. In addition, the Debtors anticipate: (i) restructuring their balance sheet, and (ii) negotiating certain of their leases with landlords. In connection with the court-supervised process, Blink filed a motion seeking approval to enter into a $73.5 million DIP Facility.

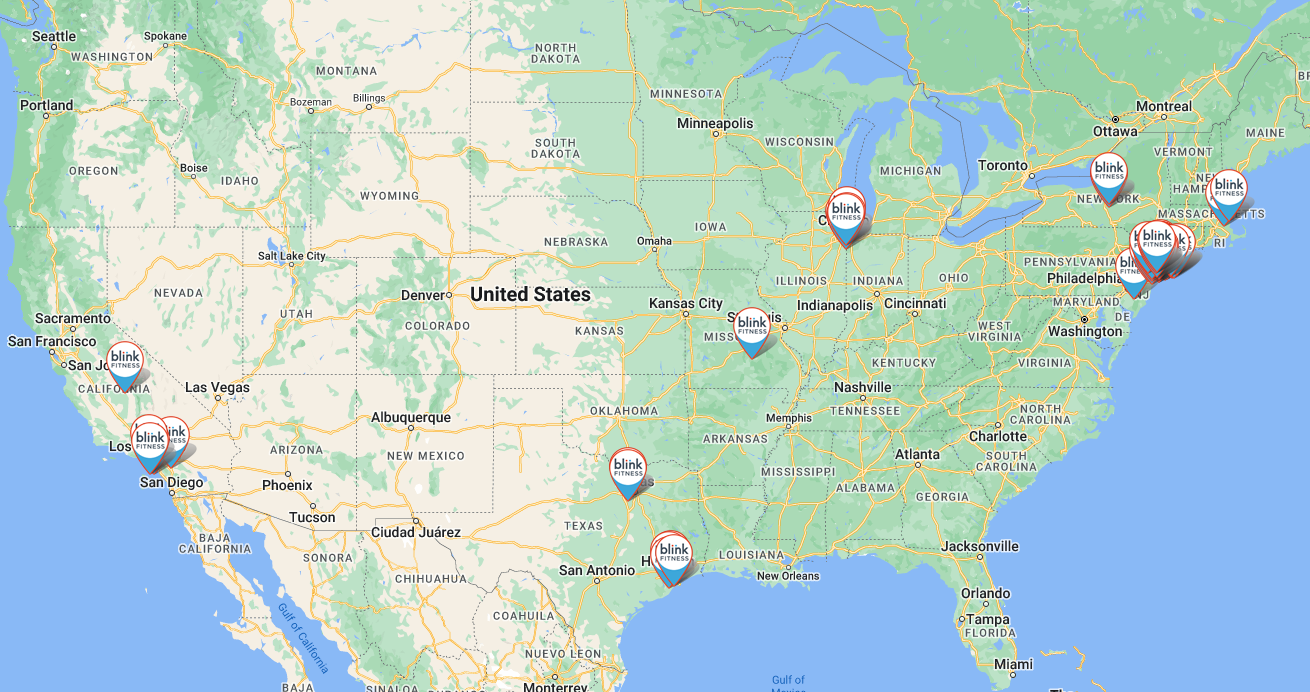

The Company has 101 fitness clubs (comprising 94 corporate-owned clubs and seven franchised clubs) under the Blink Fitness brand name. Roughly 6% of Blink's gyms are located in New York; see a map of locations below.

LL Flooring Holdings, Inc, DIP (fka Lumber Liquidators) filed a voluntary Chapter 11 petition in the U.S. Bankruptcy Court for the District of Delaware. The Company operates 430 stores across 46 states. The Debtors seek authorization from the Court to enter into two types of proposals from potential bidders: (i) bids to purchase the Debtors' business (including, at the potential purchaser's option, the Sandston Distribution Center) at a going concern value; and (ii) bids to wind down, close, and liquidate all of the Debtors' retail stores and store-level assets, if the Debtors are unable to find a viable buyer for the going concern business. The Debtors intend to identify a stalking horse bidder, if any, by August 26, in advance of a hearing on the bidding procedures motion. If a stalking horse bidder is not identified by that date, the Debtors intend to pursue a liquidation process for all stores.

The Debtors filed motions seeking approval to conduct closing sales at 94 stores. See below for those locations.

Management at Topgolf Callaway said it is conducting a strategic review, which includes potentially selling the Topgolf unit or possibly spinning it off as a separate company. The decision came as the Company said it is disappointed in its stock performance, as well as the more recent same venue sales performance. The strategic review will assess organic strategies to return Topgolf to profitable same venue sales growth, as well as inorganic strategies such as a potential spin-off.

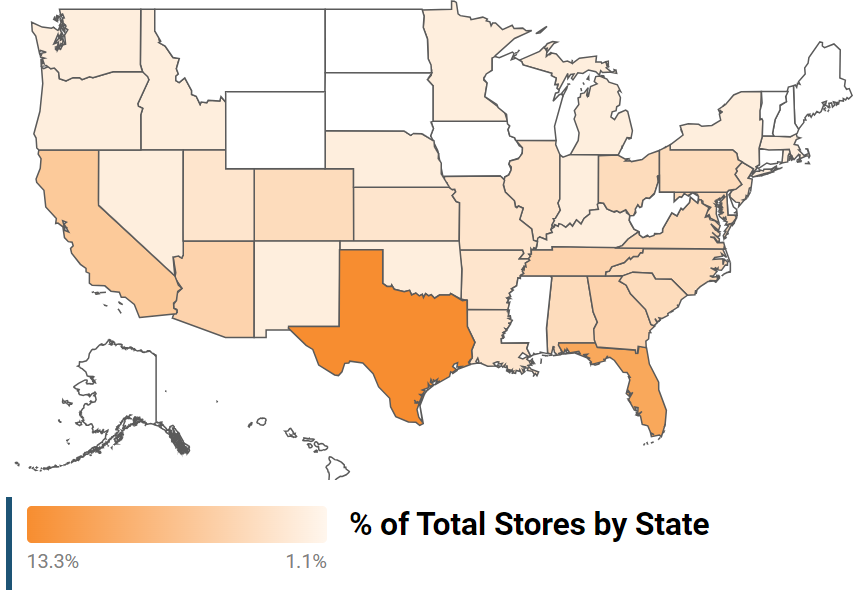

The store concentration map on the right shows that of Topgolf's 90 stores, 13% are located in Texas, 10% in Florida, and nearly 6% in California. As shown in our Real Estate Intelligence chart, Topgolf Myrtle Beach drove the most traffic in July 2024, surpassing 300,000 visits during the month. Meanwhile, its Colorado Springs location drove the least traffic of all its stores, averaging less than 30,000 visits over the past year. Altogether, Topgolf's stores average 105,000 visits per month.

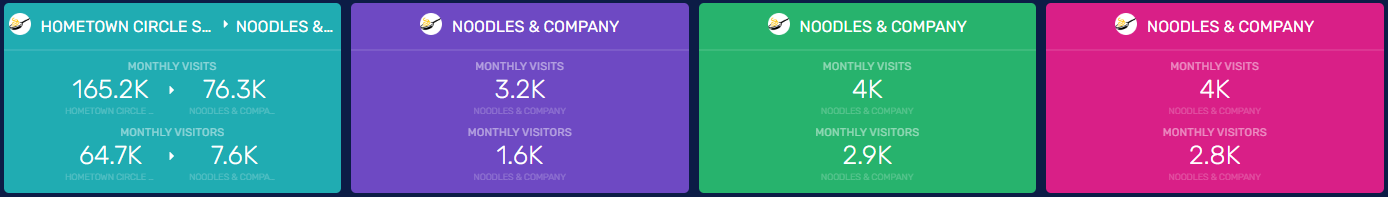

Noodles & Company has identified 20 restaurants that, combined, have accounted for contribution losses of $2 million. During its 2Q24 conference call, CFO Mike Hynes said, "We will explore closing [those restaurants] on or before their lease expiration dates. The timing of potential closures is uncertain and will be determined on a case-by-case basis.

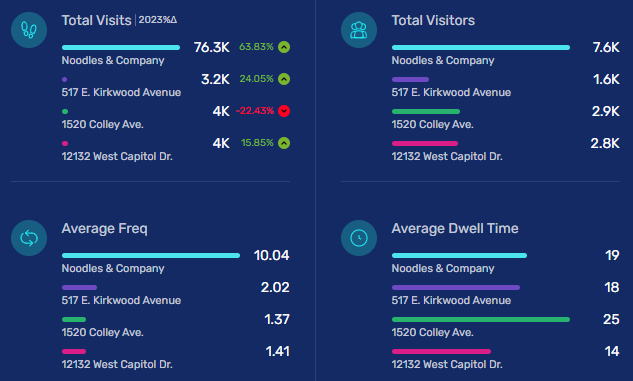

The adjacent Real Estate Intelligence chart compares the Company's highest visited location (Madison, WI) and three of its lowest visited restaurants (Milwaukee, WI; Bloomington, IN; and Norfolk, VA). The highest performing store drove 76,000 average monthly visits in 2023, compared to the three lowest performing stores, where visits were at or below 4,000.

The information contained in this newsletter is compiled from sources which RetailStat, LLC (“RetailStat”), does not control and unless indicated is not verified. Its contents are not to be divulged. RetailStat, its principals, and writers do not guarantee the accuracy, completeness or timeliness of the information provided nor do they assume responsibility for failure to report any matter omitted or withheld because of their negligence.