August 21, 2024

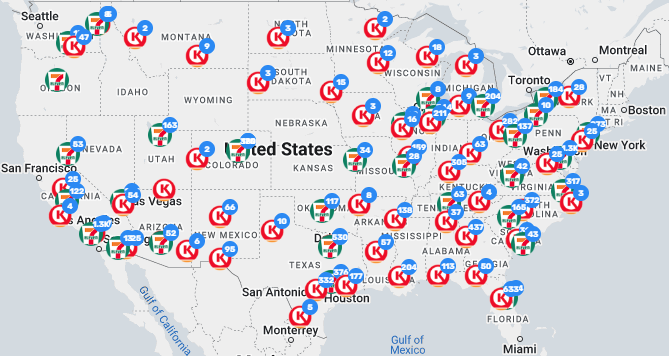

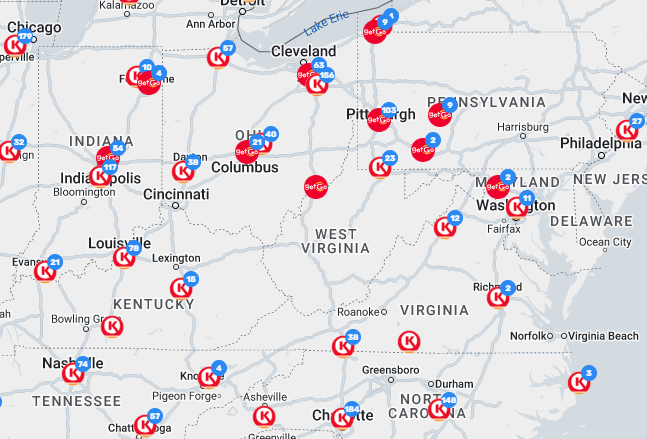

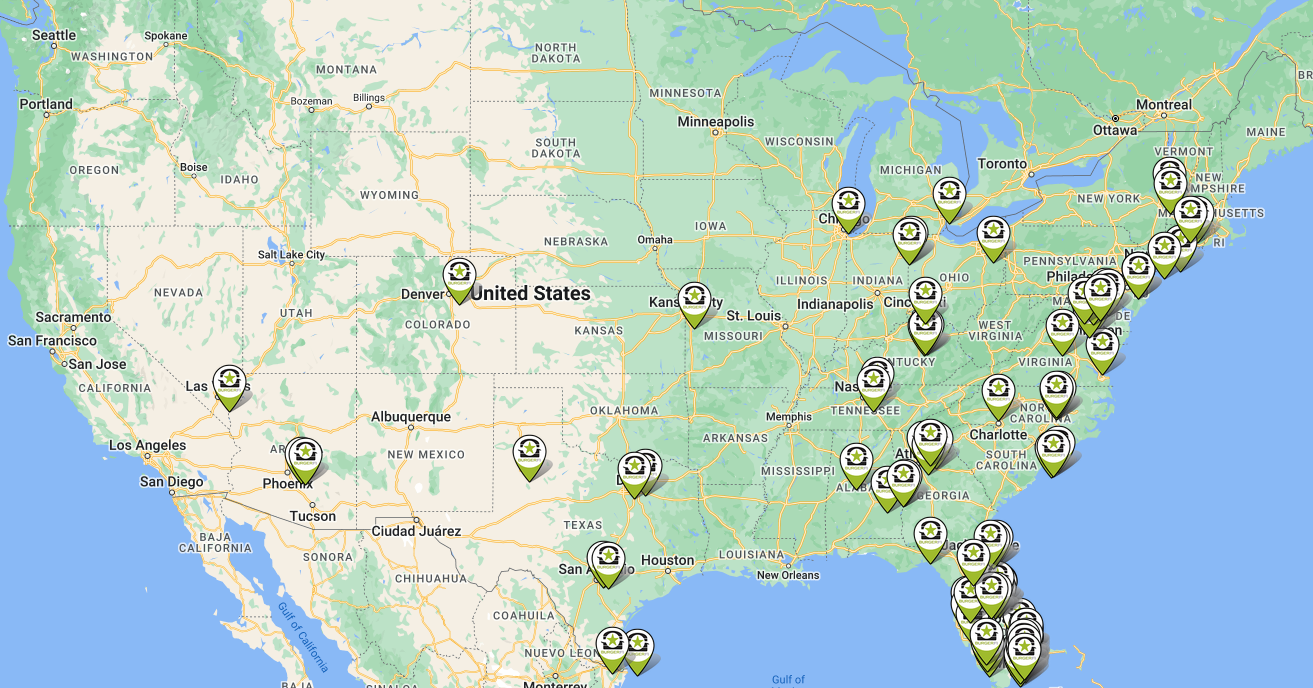

Circle K parent Alimentation Couche-Tard confirmed it has made a proposal to take over 7-Eleven owner Seven & i Holdings Co., in a transaction believed to be valued at $31 billion. If the deal is completed, it would create the world’s top convenience store operator with roughly 100,000 locations. 7-Eleven generates $67 billion in annual revenue from about 13,200 locations in the U.S. and Canada, while Couche-Tard posted revenue of $44 billion from nearly 9,300 locations in the U.S. and Canada in its fiscal year ended April 28, 2024. See the map below (left) for Circle K's and 7-Eleven's U.S. store locations.

Couche-Tard also agreed to acquire GetGo Café + Markets from Giant Eagle. GetGo operates 270 convenience retail and fueling locations across Pennsylvania, Ohio, West Virginia, Maryland and Indiana. The below map (right) shows GetGo's and Circle K's locations.

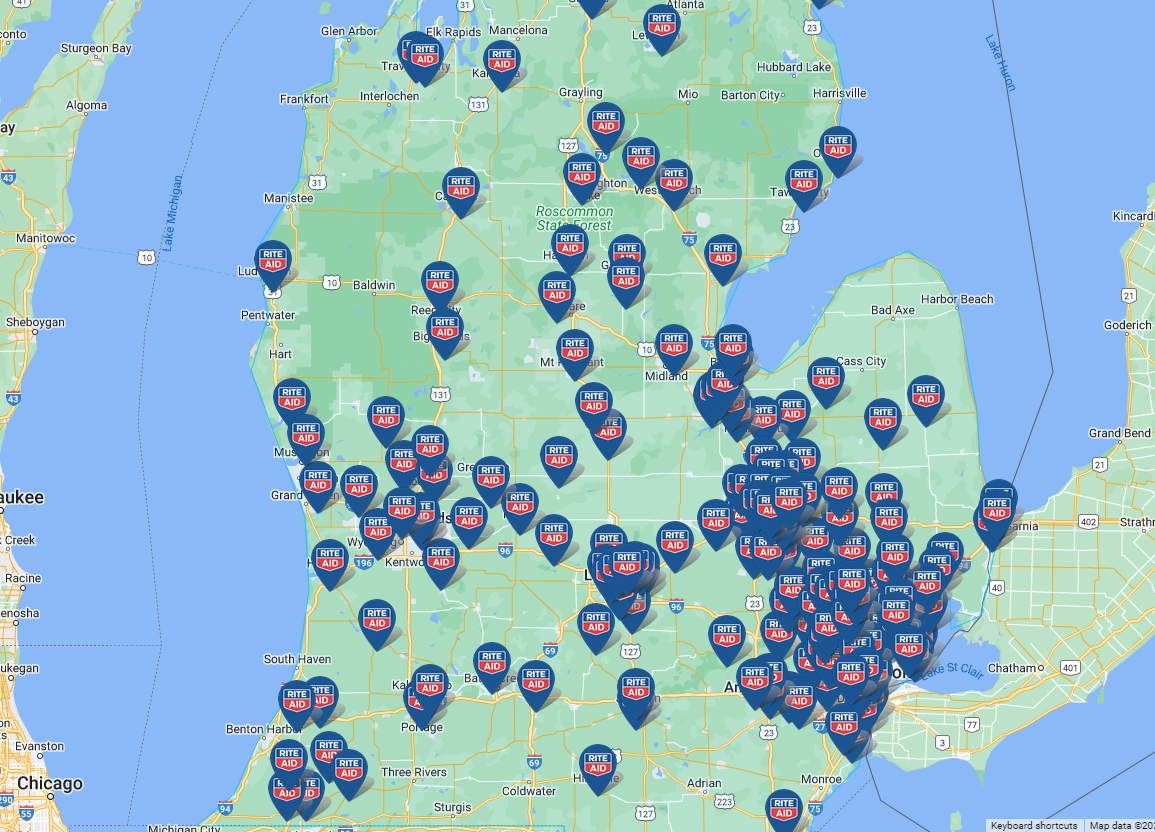

In the Rite Aid, DIP case, the Debtors identified 74 stores for closure, bringing the total of announced closures to 833. This marks the Company's exit from Michigan. Prior to filing bankruptcy, Rite Aid operated more than 186 stores in Michigan (see adjacent map). Stores have been closing on a rolling basis over the last few months, but this latest announcement will mean Rite Aid will cease operations in the state by the end of September.

We expect the Debtors to emerge from bankruptcy soon.

PGA Tour Superstore opened a new store in Overland Park, KS, its first store in the Kansas City area. The store opened in a former 30,000 square-foot Whole Foods Market in The Fountains shopping center. As the chart below shows, the Company's store count has doubled over the last five years. Full store count, including historical figures are available for download here.

BurgerFi International disclosed in a filing with the SEC that "there is substantial doubt about the Company's ability to continue to operate as a going concern." The Company has been seeking additional financing and attempting to sell some or all of its assets or the entire business. If the Company is unable to receive adequate relief, it may seek bankruptcy protection. According to recent Technomic data, sales and unit counts were both down in 2023 YOY, with the closure of six underperforming stores. This is while the rest of the fast-casual burger sector has been on an upward growth trajectory, with average sales growth of 8%.

The below map shows BurgerFi's stores across the U.S. Nearly half of the chain's restaurants are located in Florida.

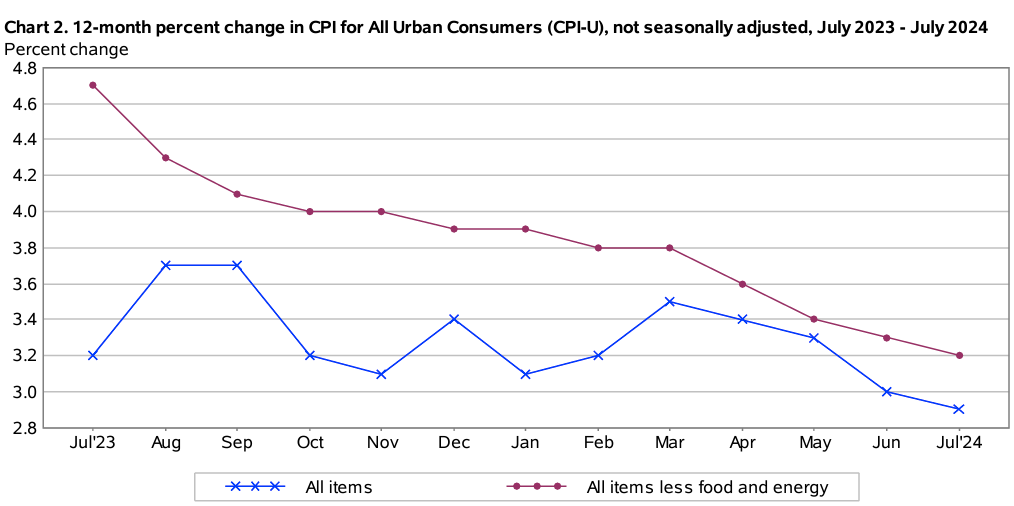

Consumer Price Index

The price for food at home rose 0.1% in July, marking the ninth straight month of a minimal increase, according to the Bureau of Labor and Statistics. On a YOY basis, grocery prices were up 1.1%. Three of the six major grocery store food group indexes increased from June to July, including meats, poultry, fish, and eggs (up 0.7%), fruits and vegetables (up 0.8%), and non-alcoholic beverages (up 0.5%). Eggs prices in particular were up 5.5%. Prices fell for other food at home (0.5%), cereals and bakery products (0.5%), and dairy and related products (0.2%).

Meanwhile, according to Brick Meets Click / Mercatus Grocery Shopper Survey fielded July 30-31, U.S. online grocery sales increased 9.2% to $7.90 billion. Delivery sales surged 22%, aided by ongoing promotional efforts. Ship-to-home climbed 6%, and pickup remained steady YOY.

The information contained in this newsletter is compiled from sources which RetailStat, LLC (“RetailStat”), does not control and unless indicated is not verified. Its contents are not to be divulged. RetailStat, its principals, and writers do not guarantee the accuracy, completeness or timeliness of the information provided nor do they assume responsibility for failure to report any matter omitted or withheld because of their negligence.