December 4, 2024

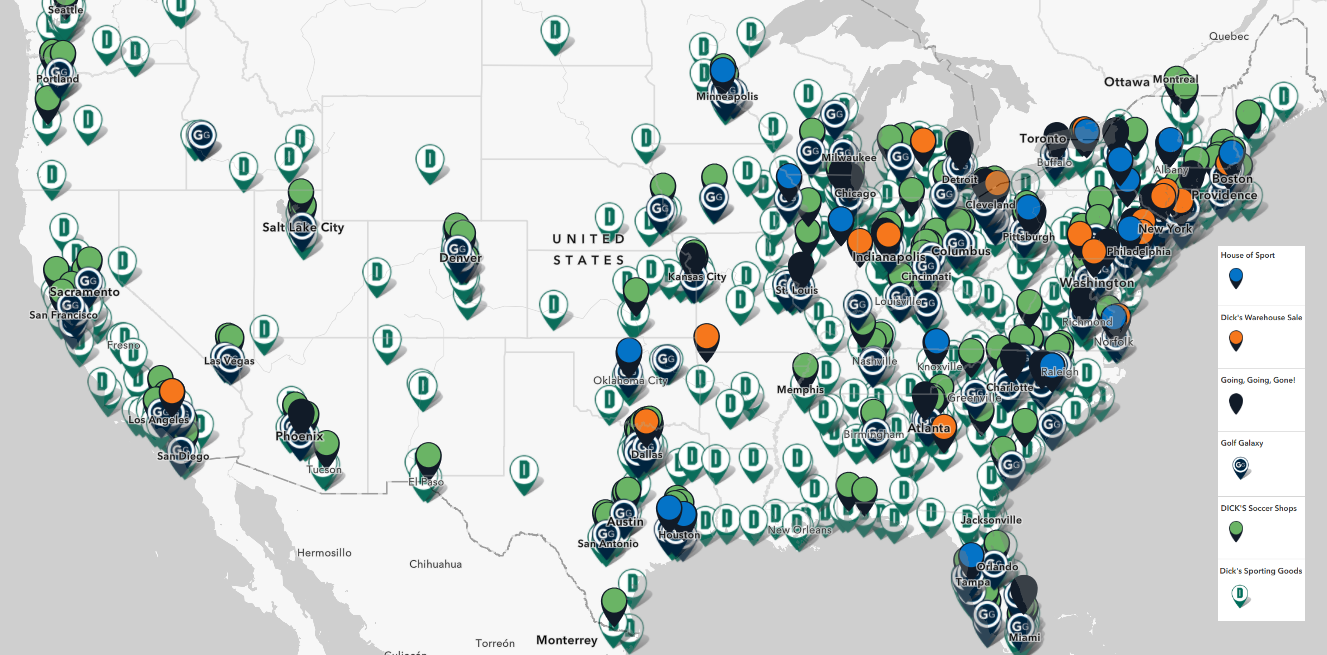

Dick's Sporting Goods reported 3Q24 sales increased 0.5%, and consolidated same store sales increased 4.2%.During YTD24, the Company opened five andclosed two legacy stores, and opened nine andclosed three specialty stores.At quarter end, it had 727 legacy stores and 137 specialty stores. The Company also operated 30 temporary Warehouse Sale stores. See the map below for the Company's locations by banner.

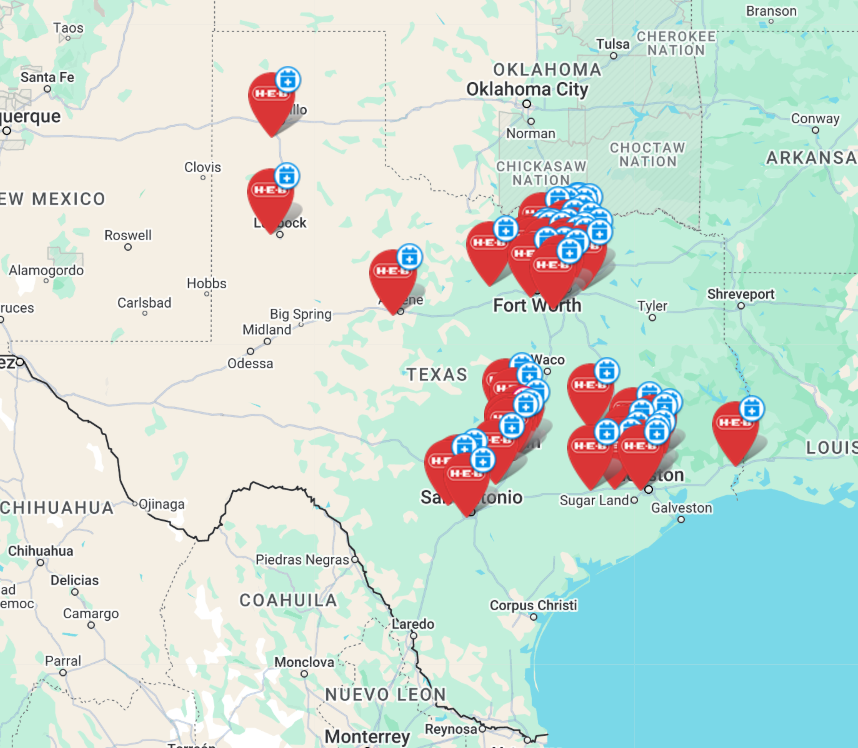

H-E-B announced a new store in East Austin, which is expected to open in late 2027. It is part of a string of openings in the greater Austin area this year, including six new stores and six remodels. The openings include H-E-B's third location in Pflugerville in November and the beginning of construction in October on a 106,000 square-foot store in Manor, which is expected to open late next year. Other future openings in the greater Austin area include a 145,000 square-foot store in Austin's South Congress neighborhood, as well as a Georgetown store in late 2025 and a San Marcos location in 2026.

In addition, H-E-B started construction on two stores in the Dallas-Fort Worth area, a 122,000 square-foot store in Murphy and a 126,000 square-foot store in Mid-Cities; both are due to open in 2026. Furthermore, H-E-B aims to open stores in Irving, Prosper, Melissa, and Rockwall, as well as a second Joe V's set in Dallas.

The adjacent map shows H-E-B's future openings, according to our Retail Openings & Closings tracker.

Amid speculation that the HBCx $2.65 billion acquisition of Neiman Marcus was in jeopardy as the Company continued to post lower sales and earnings while trade vendor payment trends remained concerningly slow, management has indicated the deal is on track and may close soon. HBCx Chairman and CEO Richard Baker recently commented, “We are on course to close the deal. It could potentially happen in the next couple of weeks. Everything is going to get done.”

The combined Company will have 77 department stores and 100 off-price outlets. The map below shows where stores are located by banner.

General Interest

Black Friday sales in the U.S. at brick-and-mortar stores grew just 0.7% YOY, according to preliminary estimates by payments processor Mastercard, while U.S. e-commerce sales increased 14.6% online. However, data firm Facteus said online sales grew 11.1% and in-store sales fell 5.4%. When factoring in inflation, those numbers drop to 8.5% online growth and 8% in-store decline.

It should be noted that this year's holiday season is shorter, as there are just 26 days between Thanksgiving and Christmas, compared to 31 last year. Facteus stated that sales at Best Buy and Target were relatively flat YOY for Black Friday, whereas e-commerce retailers including Shein, Temu, and TikTok Shop showed strong growth in sales for the seven days through Black Friday.

According to Adobe Analytics data for the period November 1 - 24, U.S. consumers spent $77.4 billion online, up 9.6% YOY and trending above Adobe's full holiday season forecast of 8.4%. Most of the spending was on electronics (up 11.4%), apparel (up 13.4%), and grocery (up 16.8%). Other categories with notable increases include furniture/bedding (up 7.2%) and cosmetics (up 10.1%). During the first 24 days of November, more than half of online spend occurred through a mobile device, a 13.3% YOY increase. Adobe forecasts mobile spending will reach a record $128.1 billion for the full holiday season at 12.8% YOY growth. Curbside pickup was down 15.9% of orders from 17.5% a year ago. The buy now pay later (BNPL) payment method drove $5.7 billion in online spend, up 3.6% YOY.

The information contained in this newsletter is compiled from sources which RetailStat, LLC (“RetailStat”), does not control and unless indicated is not verified. Its contents are not to be divulged. RetailStat, its principals, and writers do not guarantee the accuracy, completeness or timeliness of the information provided nor do they assume responsibility for failure to report any matter omitted or withheld because of their negligence.