July 17, 2024

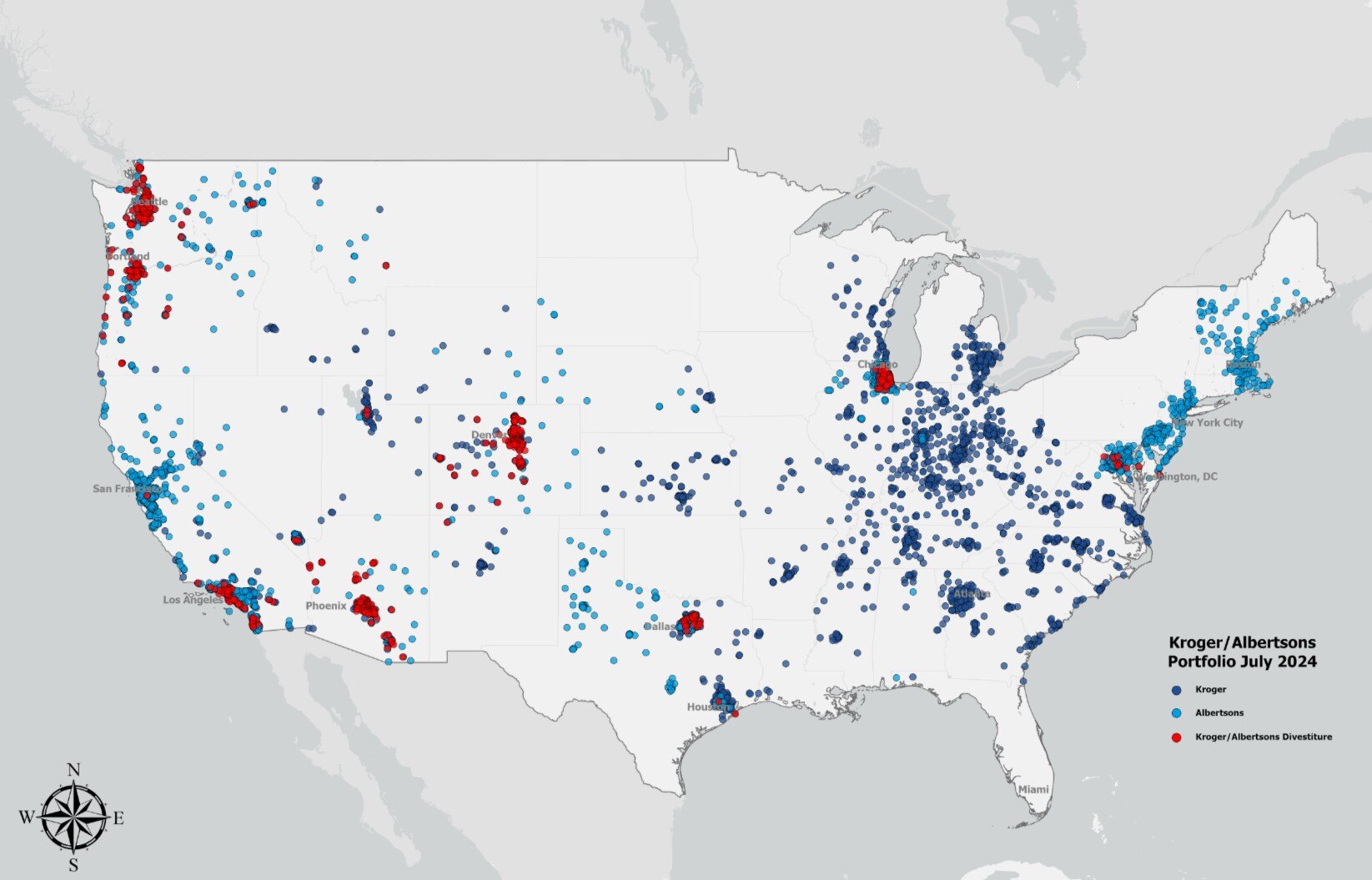

On July 9, Kroger and Albertsons released a list of the exact locations of the assets proposed to be divested to C&S in the event their merger is approved.

As we previously reported, in April 2024, Kroger and Albertsons announced an amendment to their agreement with C&S Wholesale Grocers for the sale of assets in connection with their proposed merger, previously announced on October 14, 2022. This amended package modifies and builds on the initial divestiture package that was announced in September 2023. The updated deal increases the total store count by 166 to include 579 stores that will be sold to and continue to be operated by C&S. Subject to fulfillment of customary closing conditions, including FTC and/or other governmental clearance, and the completion of the Kroger-Albertsons merger, C&S will pay Kroger an all-cash consideration of approximately $2.90 billion, including customary adjustments. In connection with the additional stores being sold to C&S, the updated divestiture package includes increased distribution capacity through a combination of different and larger facilities, as well as expanded transition services agreements to support C&S and the addition of one dairy facility. The amended divestiture package also expands the corporate and office infrastructure provided to C&S, given the increased number of stores, to ensure C&S can continue to operate the divested stores competitively and cohesively. All fuel centers and pharmacies associated with the divested stores will remain with the stores and continue to operate.

See the map below for the locations:

![]()

In May, we reported that Ahold Delhaize planned to close a number of underperforming Stop & Shop stores in the U.S. On July 12,the Company announced that Stop & Shop will close 32 stores. After the closures are complete, Stop & Shop will operate more than 350 stores spanning five states, including 81 stores in Connecticut, 115 in Massachusetts, 47 in New Jersey, 91 in New York and 25 in Rhode Island. The 32 impacted store locations, shown in the map below, are anticipated to close on or before November 2, 2024.

Macy’s announced that, following months of engagement with Arkhouse Management Co. LP and Brigade Capital Management, LP, its Board of Directors has unanimously decided to "terminate discussions with Arkhouse and Brigade that have failed to lead to an actionable proposal with certainty of financing at a compelling value." The Board intends for the management team to return its full focus to enhancing shareholder value through the execution of the Company’s “A Bold New Chapter” strategy. The Company will share additional details on the progress of its this strategy as part of its 2Q24 earnings report next month.

In the Rite Aid, DIP Chapter 11 case, the Debtors filed a motion to approve the sale of their interest in the Medimpact term loan. Following a marketing process, the Debtors’ determined that a sale to certain purchasers of $434.9 million in principal amount at a price of 90 cents on the dollar was the highest price. The remaining $125.5 million in principal amount of the MedImpact Term Loan will be distributed to certain secured creditors pursuant to the Plan.

The Debtors identified an additional 30 stores for closures, bringing the total of announced closures to 628.

![]()

MOD Pizza has been acquired by Elite Restaurant Group for an undisclosed sum. MOD is a fast casual chain with roughly 500 units in 28 states and Canada. Elite previously acquired entities like burger concept Slater's 50/50, Mediterranean chain Daphne's and Noon Mediteranean, Gigi's Cupcakes, and pizza concepts Project Pie and Patxi's Pizza.

Earlier reports suggested MOD was nearing bankruptcy, as the chain works to improve its capital structure and explore its options. Earlier this year MOD closed 26 underperforming restaurants across various states, with a concentration in California, Philadelphia, Chicago, and Dallas. MOD had previously planned to go public in November 2021, but ultimately did not proceed.

Meijer opened its first store in Indiana, in Noblesville, under the Meijer Grocery format, which debuted last year with two locations in Michigan. The 90,000 square-foot store was announced in October 2022, a fraction of the average Meijer store size of 150,000 to 250,000 square feet. The Company plans to open a second Indiana store, in Fishers, an Indianapolis suburb, which will be 75,000 square feet. Earlier this year Meijer opened its first neighborhood market outside its home state of Michigan in Cleveland, OH, spanning 40,000 square feet and selling more than 2,000 local products.

Big Y opened a new store in Middletown, CT, marking the second of three new locations planned in the state this year. The Company broke ground on the store in April 2023, and doors opened on June 20. The first opening this year took place in Brookfield, CT in May, and the third will follow in Westport, CT. A new store in Uxbridge, MA is also in the works. These locations will bring the Company's store count to 77 stores.

Lowes Foods will open a new store in Aiken, SC on July 25. The Company also plans to open stores in Lexington and Summerville, SC. In addition, the chain is expanding into Georgia, with the first store set to open this summer. The Company acquired an IGA Market in Marble Hill, GA and will transition that location into Lowes Foods in the coming months.

![]()

Lidl will open its newest store in Fresh Meadows (Queens County), NY on July 31. Other nearby Lidl stores in New York City include Elmhurst, Astoria, The Bronx, and Crown Heights. Meanwhile, the Company signed a lease to open a store in Hackensack, NJ, which is expected to open sometime in 2025. In addition, Lidl is opening in West Midtown Atlanta, GA, in a 42,000 square-foot location. Lidl U.S. operates more than 170 stores across nine East Coast states and Washington D.C.

Chedraui USA's El Super will open a 41,000 square-foot store in Bell Gardens, CA on July 17, its second El Super to open in California this year following the opening of a location in San Ysidro earlier this year. El Super operates 64 stores in California, New Mexico, Nevada, Arizona, and Texas.

General Interest

The Consumer Price Index fell 0.1% on a month-to-month basis in June, marking the first decrease since May 2020. On a 12-month basis, inflation rose 3%, which was less than expected. The slowdown in inflation heightened expectations that the Federal Reserve may cut interest rates later this year. Grocery prices remained relatively stable and continued to increase at a slower pace than restaurant inflation. The cost of food at home rose 0.1% (monthly) and 1.1% (annually), while restaurant prices increased 0.4% (monthly) and 4.1% (annually). Inflation for food-at-home and food away-from-home was up 0.2% (monthly) and 2.2% (annually). Among food categories, dairy and related products index was up 0.6% (monthly), and fruits and vegetables prices fell 0.5% (monthly). Dairy price inflation was driven by monthly increases in milk (0.8%) and ice cream (1.4%) and other dairy products (0.9%). Meats, poultry, fish, and eggs prices rose 0.2% (monthly), as poultry prices were flat and pork prices were down 0.5% (monthly), while beef and veal ticked up 0.1%, seafood prices rose 0.6%, and egg prices were up 3.5%. Cereal and bakery product prices were flat for the month, with prices down 0.1%.

The information contained in this newsletter is compiled from sources which RetailStat, LLC (“RetailStat”), does not control and unless indicated is not verified. Its contents are not to be divulged. RetailStat, its principals, and writers do not guarantee the accuracy, completeness or timeliness of the information provided nor do they assume responsibility for failure to report any matter omitted or withheld because of their negligence.